AI tools are reshaping how individuals and businesses manage money, offering faster analysis, cleaner automation, and more personalized insights than traditional finance apps. From budgeting and expense tracking to forecasting and financial modeling, modern platforms use machine learning and natural-language interfaces to turn raw transactions into clear recommendations. Whether you’re a student trying to save, a freelancer balancing irregular income, or a finance lead planning next quarter’s runway, AI-powered finance tools can reduce manual work and help you make confident decisions. Many solutions now connect to bank accounts, accounting software, and spend systems to deliver a real-time view of cash flow, recurring bills, and financial health. Some focus on proactive budgeting and subscription control, others on business spend compliance and bookkeeping automation—but all aim to improve decision-making with less spreadsheet fatigue. This page highlights the best AI finance tools available in February 2026, both free and paid, selected for usability, practical automation, and long-term value. Explore the picks below to find the right fit—whether you want to spend smarter, forecast better, or streamline finance operations.

Top Paid AI Finance Tools

| Rank | Tool | Best For | Price | Limitations |

|---|---|---|---|---|

| #1 | Ramp | AI spend management + expense automation | Custom pricing | Best fit for teams and businesses |

| #2 | Brex | AI-assisted expenses, reimbursements, and controls | Custom pricing | Geared toward companies vs. individuals |

| #3 | QuickBooks Online (Intuit Assist) | AI accounting workflows for small businesses | From $35/month | Advanced automation varies by plan |

| #4 | Aleph | AI-native FP&A, forecasting, and scenario planning | Custom pricing | Designed for finance teams (not personal budgeting) |

| #5 | YNAB | Serious budgeting with smart categorization | $14.99/month | No free tier (trial only) |

Ramp

Ramp is one of the most practical “AI-first” finance platforms for businesses because it focuses on what finance teams actually spend time on: controlling spend, collecting receipts, enforcing policy, and reconciling transactions. It combines corporate cards and expense management with automation that helps categorize purchases, match receipts, flag out-of-policy spend, and generate clean exports for accounting workflows. The AI layer is especially useful for fast-moving teams that need guardrails without adding headcount—finance can set rules, and Ramp helps enforce them with fewer manual reviews. It’s also a strong fit for companies that want real-time visibility into spend by department, vendor, or category, with faster month-end close and fewer “missing memo” chases. Ramp is best for teams (not personal finance) and typically requires a sales conversation for pricing based on company needs.

Brex

Brex is a modern spend platform built for companies that want tighter control over cards, reimbursements, and policy compliance—without slowing employees down. A standout feature for 2026 is Brex’s AI assistance for expense workflows: it can help employees complete expense documentation faster by suggesting required fields like receipts, categories, memos, and attendees, reducing back-and-forth with finance. For finance leaders, Brex supports structured approvals, spend limits, and visibility across departments, making it easier to spot waste and enforce policy consistently. It’s particularly useful for growing startups and mid-size teams that want an “intelligent finance layer” on top of day-to-day purchases. Because Brex is business-focused, the setup is overkill for individuals, and pricing is typically customized around your company’s program and needs.

QuickBooks Online (Intuit Assist)

QuickBooks Online remains a top pick for AI-driven small business finance because it sits at the center of real workflows: invoicing, bookkeeping, transaction categorization, reporting, and tax-ready records. In 2026, Intuit’s AI features (often branded as Intuit Assist in the QuickBooks ecosystem) are increasingly geared toward saving time on repetitive admin—helping automate follow-ups, surface insights from your books, and streamline routine accounting tasks so owners and bookkeepers can focus on decisions instead of data entry. It’s a solid option for freelancers, agencies, and small businesses that want an all-in-one accounting home base with smarter automation built in. The main downside is that advanced capabilities can depend on your plan and add-ons, so costs can rise as you scale. Still, for most small businesses, QuickBooks is one of the most “complete” AI-enhanced finance stacks available.

Aleph

Aleph is designed for finance teams that need FP&A horsepower: budgeting, forecasting, reporting, and scenario planning without the usual spreadsheet chaos. Instead of manually stitching together data from multiple systems, Aleph aims to centralize inputs and automate recurring work such as consolidations, variance analysis, and rolling forecasts. The AI value here is speed and consistency—helping teams move from “building the model” to “using the model” with fewer manual updates and less risk of hidden spreadsheet errors. It’s a great fit for startups and mid-market organizations that want better forecasting discipline, board-ready reporting, and faster planning cycles. Because Aleph is built for business planning, it’s not intended as a personal budgeting app, and pricing is typically custom depending on the team size and implementation needs.

YNAB

YNAB (You Need A Budget) is still one of the most effective personal finance tools in 2026 for people who want real control, not just charts. While it’s not “AI-first” in the same way as corporate spend platforms, it uses intelligent categorization and behavior-focused workflows to help users forecast true expenses, plan ahead, and break reactive spending cycles. The main strength is the system: assigning every dollar a job, staying flexible when priorities change, and building habits that improve over time. YNAB is popular with budgeting power users, couples managing shared spending, and anyone who wants a reliable structure for saving goals and monthly planning. It’s a paid product (monthly or annual pricing) with a trial, and it can feel intense at first—but for serious budgeters, the long-term payoff is huge.

Top Free AI Finance Tools

| Rank | Tool | Best For | Limitations |

|---|---|---|---|

| #1 | Empower Personal Dashboard | Free net worth, budgeting, and portfolio tracking | Best insights after linking accounts |

| #2 | Credit Karma | Credit monitoring + personalized finance recommendations | Product offers can be promotional/affiliate-driven |

| #3 | ChatGPT (Free) | One-off financial analysis, explanations, and summaries | Manual input; not a connected finance dashboard |

| #4 | Fidelity Full View | Free account aggregation + budgeting overview | Features depend on supported account links |

| #5 | Rocket Money (Free Plan) | Tracking subscriptions and spending trends | Premium required for full automation (e.g., assisted cancellations) |

Empower Personal Dashboard

Empower Personal Dashboard is one of the best free “big picture” finance tools in 2026 because it gives you clarity fast: net worth tracking, spending insights, portfolio views, and planning tools in a single dashboard. After linking accounts, it can automatically categorize transactions, visualize cash flow, and show where money is going month to month—making it useful for both budgeting and long-term planning. While it’s not a pure budgeting coach like YNAB, it’s excellent for anyone who wants a free, consolidated view across bank accounts, credit cards, loans, and investments without building custom spreadsheets. The strongest value is visibility: it’s easier to make good decisions when you can see the whole system. Like most free dashboards, the experience improves significantly once accounts are connected and your data is complete.

Credit Karma

Credit Karma is a long-running free finance platform that helps users monitor credit scores and reports while also surfacing personalized recommendations for products like credit cards, loans, and banking. For many people, credit is the “hidden lever” behind financial outcomes—interest rates, approvals, and borrowing costs—so having a free tool to track progress can be genuinely valuable. Credit Karma is best for consumers who want to understand and improve their credit profile, check for changes, and get guidance on next steps. The main limitation is that recommendations can be marketing-driven, so it’s smart to treat offers as starting points and compare options before applying. Used thoughtfully, it’s a strong free companion tool in a modern AI-enhanced finance stack.

ChatGPT (Free)

ChatGPT’s free tier can be surprisingly useful for finance—especially when you need explanations, summaries, or decision support without installing a new app. You can paste anonymized budget categories, spending notes, or a list of recurring expenses and ask for patterns, optimization ideas, or a simple action plan. It’s also great for translating financial concepts into plain language: debt payoff strategies, how APR works, what a cash-flow forecast means, or how to structure a basic personal budget. The key limitation is that it’s not an integrated dashboard—you must provide the inputs manually, and it won’t automatically pull transactions. For one-off analysis and “thinking help,” though, it’s a flexible free option.

Fidelity Full View

Fidelity Full View is a free aggregation and monitoring tool that helps you track accounts and build a clearer view of your financial life in one place. It’s useful for people who want a lightweight alternative to paid dashboards: you can monitor balances, track spending and income, and review your financial picture across multiple institutions. For budgeting, it provides a practical overview without requiring a strict methodology. It’s especially helpful if you already use Fidelity for investing, because it can complement portfolio tracking with broader “whole-life” finance visibility. The main limitation is that features and data quality depend on which external accounts can be linked successfully, which varies by institution.

Rocket Money (Free Plan)

Rocket Money is well-known for subscription visibility and consumer-friendly budgeting features, and its free plan can still be valuable for tracking spending patterns and recurring charges. Once accounts are connected, you can identify subscriptions you forgot about, monitor upcoming bills, and get a clearer view of where money is leaking month after month. For many users, that alone creates quick wins—cutting a few unnecessary subscriptions often pays for the effort immediately. Rocket Money becomes more “automated” on premium tiers (especially for assisted cancellation and certain services), so the free plan is best viewed as a discovery and tracking layer rather than a fully hands-off solution. If you want a simple starting point for tighter spending awareness, it’s one of the easiest free options to adopt.

Rankings

Chatbots

AI chatbots have quickly evolved from simple assistants into powerful, multi-purpose tools used by millions of people every day...

Image Generators

AI image generators are revolutionizing the way creatives, marketers, and developers produce visual content by transforming text prompts into detailed, customized...

Writing Assistants

AI writing assistants have become indispensable tools for anyone who writes — from students and bloggers to business professionals and marketers...

Deepfake Detection

As deepfake technology becomes more advanced and accessible, detecting AI-manipulated content is now a critical challenge across journalism, education, law, and...

Productivity & Calendar

AI productivity and calendar tools have become essential for professionals, entrepreneurs, and students looking to make the most of their time without getting overwhelmed...

Natural Language To Code

Natural language to code tools are transforming software development by enabling users to build apps, websites, and workflows without needing advanced programming...

Blog

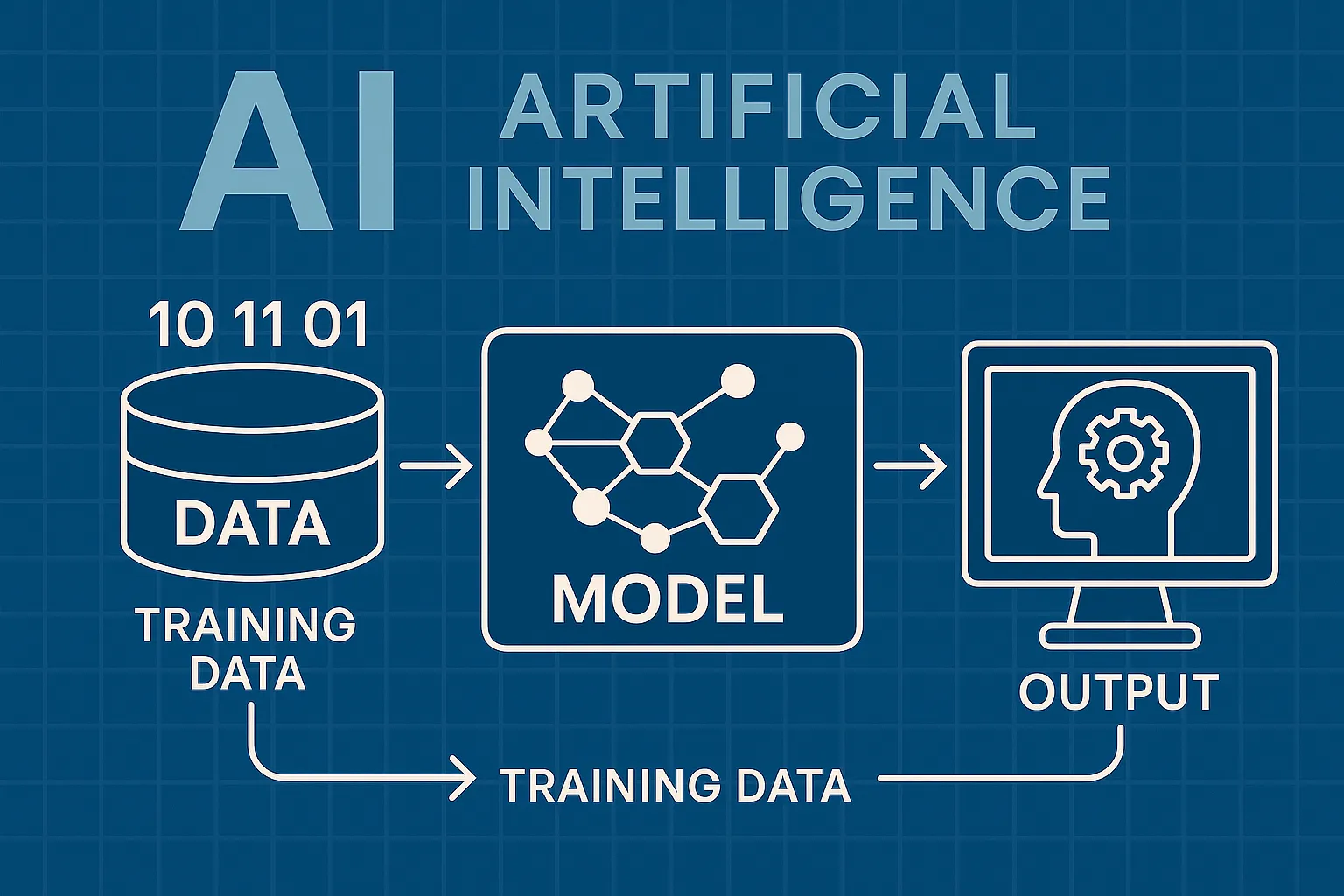

How AI Actually Works

Understand the basics of how AI systems learn, make decisions, and power tools like chatbots, image generators, and virtual assistants.

What Is Vibe Coding?

Discover the rise of vibe coding — an intuitive, aesthetic-first approach to building websites and digital experiences with help from AI tools.

7 Common Myths About AI

Think AI is conscious, infallible, or coming for every job? This post debunks the most widespread misconceptions about artificial intelligence today.

The Future of AI

From generative agents to real-world robotics, discover how AI might reshape society, creativity, and communication in the years ahead.

How AI Is Changing the Job Market

Will AI replace your job — or create new ones? Explore which careers are evolving, vanishing, or emerging in the AI-driven economy.

Common Issues with AI

Hallucinations, bias, privacy risks — learn about the most pressing problems in current AI systems and what causes them.